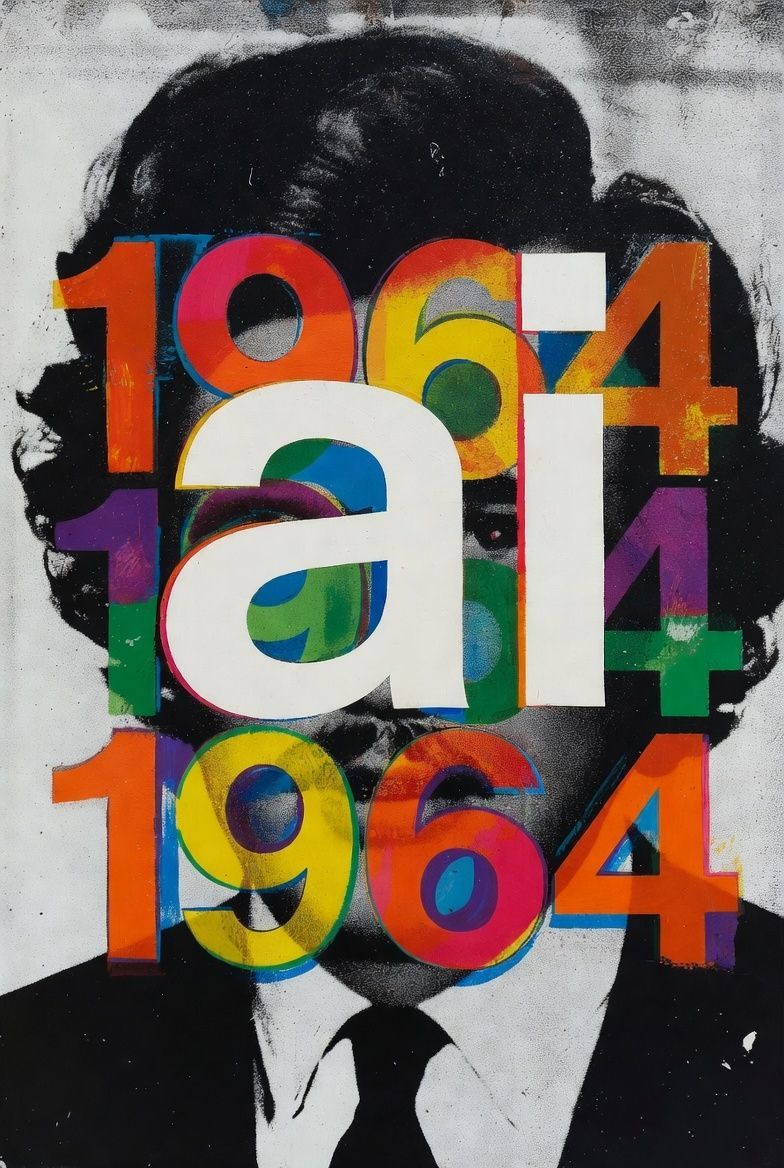

Key AI & Tech Developments (November 9-10, 2025)

Key AI & Tech Developments (November 9-10, 2025)

The weekend of November 9-10 saw a surge in AI infrastructure announcements, open-source efficiency breakthroughs, and early signals of impending model releases, amid ongoing debates about market sustainability. Highlights include major investments in data centers and agentic systems, with open-source advancements dominating research chatter. Below is a curated summary of the most impactful updates, drawn from real-time news and discussions.

AI Model & Research Breakthroughs

-Google's Nested Learning & Hope Model: Google Research unveiled "Nested Learning," a paradigm treating LLMs as interconnected optimization problems to enable continual learning without catastrophic forgetting. The proof-of-concept "Hope" model demonstrates superior reasoning and self-modification, potentially paving the way for brain-like AI architectures. This could be a landmark paper for 2025, emphasizing efficiency over scale.

-Diffusion Language Models Outperform in Low-Data Scenarios: A new arXiv paper (November 5, but widely discussed over the weekend) from researchers including Hoifung Poon introduces diffusion-based models that surpass autoregressive LLMs like GPT-series on limited datasets. Using iterative bidirectional denoising and synthetic data, it addresses the AI "data crisis," boosting generalization and scalability.

-Alibaba's Tongyi DeepResearch & AgentFold: Alibaba open-sourced Tongyi DeepResearch (30B params), a web agent beating GPT-4o on long-horizon tasks with just $500 hardware, via synthetic data pipelines. Companion AgentFold adds proactive memory folding, outperforming 20x larger models on extended interactions—key for persistent, efficient agents.

-Sentient AGI's NeurIPS 2025 Papers: Four accepted papers spotlight open-source AGI security, including OML 1.0 for model fingerprinting and ROMA v2 for recursive multi-agent decomposition. MindGames Arena debuts self-play for emergent learning, reducing errors in collaborative systems.

-Meta's SPICE Framework: Meta's self-play system (Self-Play in Corpus Environments) turns LLMs into autonomous reasoners, mining internet challenges for +11.9% benchmark gains without external datasets—open-sourced for dataset-free self-improvement.

Infrastructure & Hardware Investments

-Meta's $600B AI Buildout in the US: Meta confirmed a massive $600 billion investment in US-based AI infrastructure, focusing on data centers and energy-efficient compute to support frontier models. This aligns with global projections of $1.5 trillion in AI/data center spending for 2025.

-NVIDIA-Kazakhstan $2B AI Chip Deal: NVIDIA signed a $2B MOU with Kazakhstan for advanced AI chips, accelerating regional compute capacity amid US export restrictions on China.

-Asia's Data Center Boom: Regional investments hit record highs, with Asia leading global expansions (e.g., hyperscalers in Singapore and Japan) to handle AI's energy demands, estimated at 8,000 GWh annually by 2030.

-OpenAI-Oracle-Vantage AI Capacity Project: A joint venture announced new data centers with air/liquid cooling, delivering 250+ MW for AI training—part of broader hyperscaler pushes.

Key AI & Tech Developments

Building on the weekend's momentum, November 9-10 brought fresh waves of efficiency-focused open-source releases, hardware innovations, and policy tensions. Discussions on X amplified buzz around agentic AI and synthetic data, while global investments underscored infrastructure's role in sustaining the boom. Here's a curated extension of the most notable updates, emphasizing emerging tools, geopolitical ripples, and scalability challenges.

AI Model & Research Breakthroughs (Continued)

xAI's Grok 4 Upgrade: 2M Token Context & Imagine Enhancements: Elon Musk demoed Grok 4 Fast, now handling 2 million tokens (5x GPT-5's capacity) with 98% completion accuracy, processing dual copies of War and Peace seamlessly. Grok Imagine generates hyper-realistic photos/videos from text prompts, blurring AI-art boundaries—tested live on X for emotional, cinematic outputs like rain-soaked confessions.

Moonshot AI's Kimi K2 Thinking Agent: Open-sourced agent model hits state-of-the-art on HLE (44.9%) and BrowseComp (60.2%), supporting 256K context and 300+ tool calls. Ideal for long-horizon web tasks, it's a lightweight alternative to closed agents.

Microsoft's MAI-Image-1: First in-house image generator from Microsoft, open for developers, excels in high-res outputs with reduced artifacts—trained on diverse datasets for creative workflows.

Google's Gemini 2.5 Computer Use Model: New API release enables agents to interact directly with UIs, automating desktop tasks like browsing or editing. Paired with Vertex AI Agent Builder updates for production-scale deployment.

DeepSeek's Pessimistic Outlook on Humanity: Amid releases, DeepSeek's team voiced concerns over AI's societal risks, calling for ethical safeguards in open-source scaling—sparking X debates on alignment.

Infrastructure & Hardware Investments

Google's AI Chips with 4x Performance Boost: New TPUs deliver fourfold efficiency for model training, tied to a multi-billion Anthropic cloud deal. Positions Google to challenge NVIDIA in scalable AI compute.

Qualcomm's AI250 Memory Architecture: Unveiled for edge AI, boosts bandwidth for on-device workloads—key for mobile agents and robotics.

US Blocks NVIDIA Exports to China: Escalating AI rivalry, export curbs tighten, pushing Kazakhstan's $2B NVIDIA deal as a workaround for regional access.

Asia's Data Center Surge: Investments exceed projections, with Singapore/Japan hyperscalers targeting 8,000 GWh AI energy needs by 2030—fueled by Alibaba/Meta expansions.

Industry & Market Shifts

DevelopmentDetailsImpactOpenAI's Consumer Health ToolsSuite of gen-AI apps for personalized wellness (e.g., symptom tracking, nutrition plans), powered by GPT models—codenamed "AFM v10."Expands AI into daily health; privacy via on-device processing, but raises data ethics flags.Seoul National University's KVzipCompresses chatbot memory 4x without accuracy loss, using key-value optimization for long convos.Enables efficient persistent agents; open-source potential for mobile AI.Undergrad-Led AI Robotics Lab ($100K Build)Automates material synthesis via ML-robotics integration, skipping manual trials—handles loading, measuring, predicting.Democratizes R&D; low-cost setup accelerates discovery in chemistry/materials science.EU AI Law Delay PressuresBig Tech/US lobbying for 1-year grace on high-risk rules; fines postponed to 2027.Slows enforcement, boosting innovation but risking unchecked biases—echoes X calls for balanced regs.Wall Street AI Bubble Fears IntensifyNasdaq dips 2.5% on capex worries; Palantir/Oracle/NVIDIA down further, despite Meta/MSFT vows for $300B+ 2025 AI spend.Signals correction; analysts split on sustainability vs. dot-com redux.

Emerging Trends & Tools

Synthetic Data & Efficiency Dominance: Papers like "Diffusion Language Models are Super Data Learners" (arXiv Nov 5) show diffusion models beating autoregressives on sparse data via bidirectional denoising—addressing the "data crisis." X threads hail it as a 2025 paradigm shift.

Agentic & Multimodal Leaps: FutureHouse's Kosmos audits 1,500 papers/42K code lines for verifiable research; BAAI's Emu3.5 unifies video/text/image gen, rivaling closed rivals. olmOCR 2 boosts doc handling 20%.

Open-Source Robotics & Bio-AI: NVIDIA's Clara Reason (radiology reasoning) and OpenMind AGI's OM1 OS ($20M-funded) enable on-chain robot economies—sim-to-real transfer for economic agents.

Model Release Frenzy Builds: GPT-5.1 (Nov 24), Gemini 3 Pro preview (Nov 12), Genie 3, Claude Opus 4.5—poised for creative/agentic surges. India gets free premium access (ChatGPT Go, Gemini Advanced via Jio/Airtel).

Mind-Captioning Breakthrough: Stanford's technique translates brain scans to text, advancing neural interfaces—early X demos show descriptive outputs from thoughts.

Broader Implications

These developments underscore AI's pivot toward efficiency and openness, countering scale-driven bubbles with synthetic data and modular agents. However, geopolitical tensions (e.g., US chip curbs) and ethical calls (e.g., EU AI law delays) highlight risks. Investors eye infrastructure as the "picks and shovels" play, while developers benefit from free premium tools in markets like India. For deeper dives, watch NeurIPS proceedings and Q4 earnings for validation.