The Great AI Profitability Race (OpenAI, Anthropic, Perplexity, Microsoft, Google)

By Jason Wade, Founder NinjaAI and AiMainStreets • November 16, 2025

TLDR

The global race for profitable, sustainable AI is no longer just about who can build the smartest model—it's about which companies can actually turn astronomical hype into real, lasting value. Anthropic, creator of Claude, is expected to reach profitability years ahead of OpenAI. Perplexity AI, the research-driven, fast-growing platform, is quietly inching close to sustainable earnings and differentiated business value. Microsoft sits in the catbird seat, raking in profits from Azure every time OpenAI—or anyone else—deploys an LLM at scale, even as its own Copilot products continue to improve. Meanwhile, Google’s Gemini stack—deeply woven throughout Cloud, Workspace, and the world’s biggest search platform—demonstrates the sheer power of ecosystem integration: Gemini and Google are already profitable in the enterprise AI race. Ultimately, the business model and financial outcomes for each player will determine not just who wins the technology race, but which AI tools business owners, consultants, and agencies should trust for the long haul. Understanding who’s burning cash, who’s managing spend, and who’s making money reveals more than just financial health—it predicts product stability, future pricing, business risk, and ultimately, client impact for those betting their workflows on AI.

Why AI Profitability Matters (And Why You Need To Care)

It’s easy to get caught up in the headlines about LLM benchmarks, new feature launches, or mind-blowing image generation demos. But beneath the surface is a fiercely practical question: can these AI giants turn their dazzling technology into sustainable, real-world profit? That question isn’t just for investors with skin in the game—it affects everyone using AI as a core part of their business operations or client offerings. A vendor’s profitability (or lack thereof) hints at how stable, maintained, and affordable their product will be in years to come. For consultants, agencies, or local business owners trying to build stable workflows or package services on AI, knowing who’s making money is as important as knowing who has the best API or the shiniest new model.

Anthropic (Claude): The Quiet Business Juggernaut

While OpenAI grabs more headlines, Anthropic’s approach could prove to be the future template for professional AI. Anthropic is on track to hit break-even by 2028—ahead of all other independent labs—by courting enterprise clients, focusing on reliability and safety for business workflows, and controlling its infrastructure spending. The company’s hypothesis is simple: making enterprise AI boringly dependable is more valuable, long-term, than dominating Twitter hype cycles with splashy consumer bots. Inside the LLM world, the difference is clear—Claude shines on nuanced research, legal reasoning, and structured synthesis (especially once you get hands-on with policy, contracts, or compliance-heavy industries). By structuring its revenue stream around business customers (not just consumers), Anthropic locks in predictable, high-value income and spends less on risky modalities like video or consumer hardware. This discipline comes at a time when AI companies need to prove they’re more than just emergent science experiments, and their approach is built for exactly that.

OpenAI (ChatGPT): Bet the Farm, Burn the Cash

OpenAI, on the flip side, is gunning for AI world domination. Their philosophy is to plant flags everywhere: ChatGPT is the brand everyone recognizes, and its underlying API fuels everything from creative bots to SaaS automations. To keep exploding in every direction—image, video, multimodal agents, hardware, and possibly even an app store—OpenAI continues to burn through billions, not just in R&D but also in massive Azure infrastructure bills. The road to profitability, by their own projections, is closer to 2030 than any time sooner, with multi-billion-dollar annual losses certain through at least 2028. The upside: OpenAI’s sheer ambition means their model is always chasing the limits of what’s possible. The downside, especially for businesses: such “grow at all costs” strategies create price volatility, potential sudden changes to free or discounted access tiers, and ultimately, risks for those who build mission-critical workflows on their stack. In other words: OpenAI is placing big, visionary bets. Will all of them pay off—and how will they need to change if venture capital ever gets more expensive?

Perplexity AI: The Underdog with Real Revenue

Then there’s Perplexity AI—perhaps the most quietly disruptive force in the field. You’re reading this courtesy of Perplexity’s platform, which means you’re seeing firsthand how high-quality, real-time answers and a focus on honesty, transparency, and reliability have built a dedicated user base. Instead of outsized hype cycles, Perplexity has methodically grown to more than 20 million users (and counting), with a business model based on freemium subscriptions, enterprise API deals, and a growing research-focused ecosystem. Approaching or exceeding $100 million annualized revenue, and running a substantially leaner operation than the mega-labs, Perplexity’s path to profitability is less cluttered with legacy costs or reckless bets. For consultants, researchers, and business owners who demand up-to-date, verifiable answers (not just black-box model outputs), Perplexity’s value proposition is both clear and positioned for long-term relevance.

Microsoft: The Power Behind the Curtain

You can’t talk about this market without talking about Microsoft, the ultimate infrastructure winner. Every time OpenAI trains or serves ChatGPT—or, increasingly, whenever another AI provider leases compute at cloud scale—Microsoft’s Azure cashes in. Even better, Microsoft’s multi-year deals give it a front-row seat for any future “AI singularity”—for once in tech history, the platform vendor gets paid no matter which app or service wins. Microsoft also packages its own Copilot-branded AI throughout Office, Dynamics, and Windows, further ensuring recurring revenue. While its own LLM user experiences may lag behind the pure-play labs in terms of conversational nuance or creative flair, Copilot’s deep integration into existing software markets carves a different, more predictable path to AI monetization than either Anthropic or OpenAI. Put bluntly: Microsoft’s interests are aligned with scale, stability, and facilitating everyone else’s AI business—if with less artistic flash.

Google (Gemini): Quietly Dominant, Already Profitable

Google knows a thing or two about profitable platforms—and Gemini, their flagship generative AI, is now seamlessly embedded into Search, Cloud, Ads, Workspace, Maps… you name it. The magic: Google is already deeply entwined with the day-to-day lives of billions in enterprise and consumer realms, so selling more AI to its existing customers is mostly upside, low cost, and highly defensible. Unlike the labs racking up compute bills to chase new users, Google simply activates Gemini features where demand is proven and billing is already in place. That keeps margins high, risk under control, and enables relentless improvement without existential cash burn anxiety. For AI-powered businesses who want “boringly powerful” tools—with compliance, privacy, and integration built in—Gemini’s approach feels nearly recession-proof.

What Do the Business Models Mean for the Future?

In my own agency and digital business work—whether building with Ninja AI, rolling out new SEO automations, or advising local professionals—the question of AI vendor sustainability looms large. For years, the industry has equated “raising the most money” with having the best product. That’s changing. Now, stability, pricing transparency, and product reliability are increasingly winning out. If your core workflow sits atop a model that might be deeply unprofitable for years, you run real business risk. What happens if that vendor pivots, raises prices, or sunsets products? In contrast, working across multiple platforms—Claude for legal syntheses, ChatGPT for creative prompt generation, Perplexity for research validation, and, yes, Gemini for enterprise deployments—hedges that risk with practical resilience.

The “Stack Diversification” Advantage: Future-Proofing Your Workflows

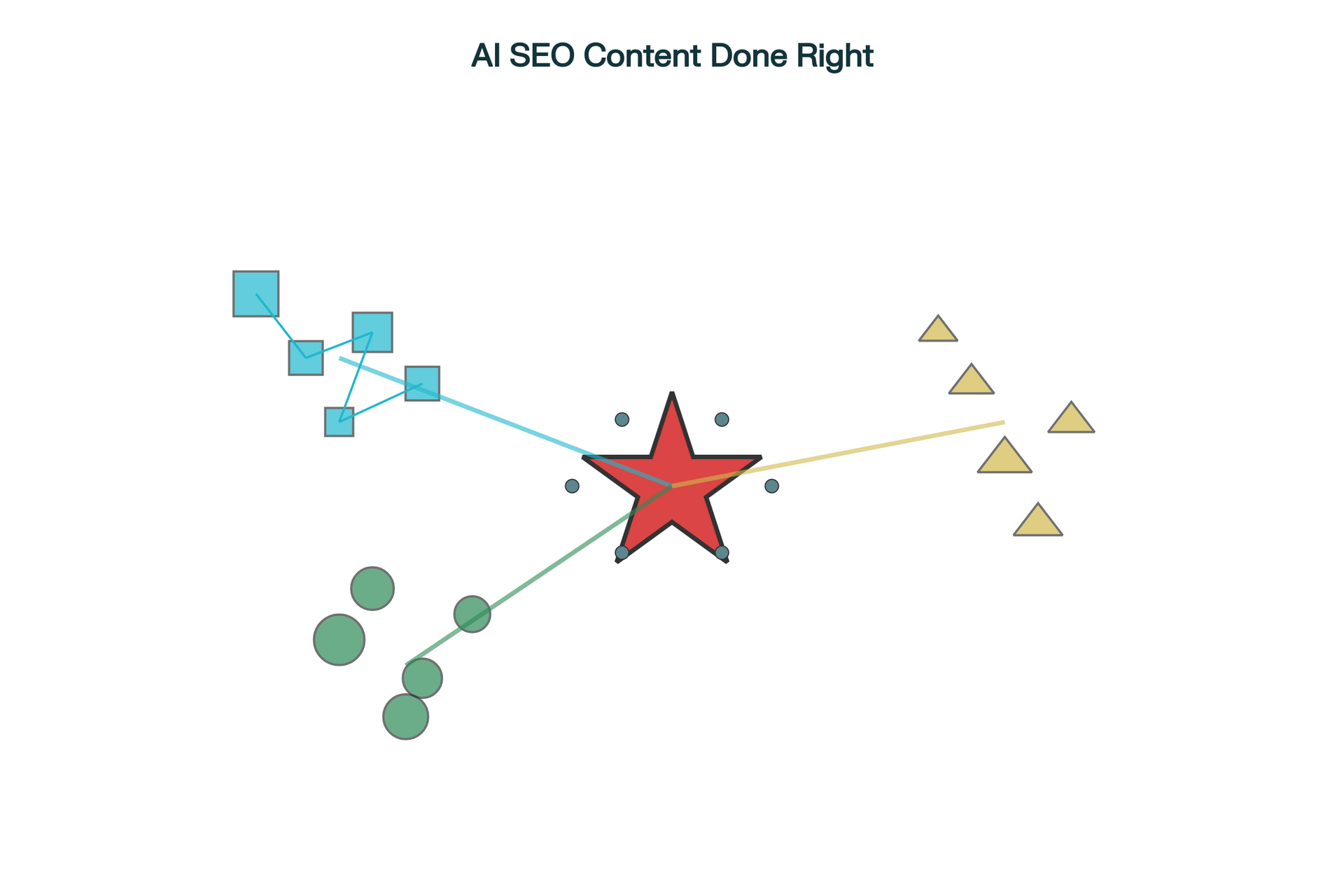

No single AI tool covers every use case perfectly. That’s why the smart business owner or consultant learns to blend AI tools—ChatGPT to kick things off, Claude for structured research, Gemini for seamless Google integration, and Perplexity to vet sources and validate claims. Mixing platforms is like diversifying investments: you’re less reliant on a single vendor’s success, and you gain early insight into new features, compliance trends, and pricing changes. This adaptability isn’t just a technical trick—it’s a core business skill. Just as cloud computing disrupted on-premise software by providing flexible, scalable backend options, diversified AI stacks are now the linchpin of robust business automation.

Practical Impact: For Consultants, Agencies & Local Businesses

Let’s get real: Most businesses aren’t building the next ChatGPT—they’re quietly automating operations, improving client deliverables, optimizing marketing, and managing compliance. Profitability at the vendor level directly affects your costs, pricing power, and client reliability. Imagine locking into a deeply discounted API, building your products around it, and then discovering—six months later—that your partner must double prices just to keep the lights on. Understanding profitability trajectories lets you anticipate—and avoid—these scenarios. Companies like Anthropic and Perplexity, by committing to lean models and business-aligned revenue, are in a better position to give their users predictability. Google’s integration expertise means fewer product surprises, while Microsoft’s scale promise means uptime and support are not going anywhere. Only OpenAI, for all its category-defining success, remains the biggest wild card—its ambition is breathtaking, but business consequences for clients are uncertain if VCs cool on AI spending.

The Road Ahead—What to Expect by 2030

If the trend holds, we’re facing consolidation: fewer, bigger winners, each staking out their territory. Product prices may increase as costs inevitably rise and experimentation yields to reliable revenue models. The power users—the consultants, creators, and strategists—will draw on multiple platforms, picking the best tool for the job and playing vendors against one another for pricing and feature concessions. The big beneficiaries? Those who can combine creative power (ChatGPT’s edge), deep knowledge (Claude and Perplexity), and operational stability (Google & Microsoft) without brand fanaticism or vendor lock-in. Whether you’re selling AI-powered legal audits in Florida or rerouting an e-commerce operation to maximize Gemini’s latest API, knowing the winners in the AI profitability race helps you future-proof your business.

20-Question FAQ

1. What is the AI profitability race?

The AI profitability race describes the competition between major AI vendors to prove they can not only invent cutting-edge technology but also turn that technology into sustainable, long-term profit. It matters because it will determine which vendors are around next year—and which features, prices, and service levels you should expect.

2. Who will be profitable first: OpenAI, Anthropic, Perplexity, Microsoft, or Google?

Anthropic is projected to break even by 2028; Perplexity, with rapid ARR growth and lower costs, may get there even sooner; Google is already profitable with Gemini; Microsoft profits via Azure with every AI partnership; OpenAI is targeting 2030 for profitability.

3. Why does profitability matter for agencies and business buyers?

Profitable companies offer stability, predictable pricing, and ongoing product investment. High-burn vendors risk discontinuing products, raising prices, or reducing support if funding dries up.

4. Why is Anthropic’s business-first model working?

Anthropic’s discipline in courting business users and focusing on reliability ensures a steady, predictable cash flow—making it easier to control costs and invest for the long haul.

5. How does Perplexity generate revenue?

Perplexity combines subscriptions, enterprise API contracts, and search partnerships, growing with a lean cost structure and emphasizing real-time information and citation accuracy.

6. What’s OpenAI’s biggest financial strength?

Sheer scale and brand power—OpenAI’s diverse lineup and headline-generating innovation attract users and enterprise contracts.

7. What’s OpenAI’s biggest financial risk?

Massive, ongoing operating losses and heavy reliance on fundraising. If the investment climate changes, prices or access could shift quickly.

8. Do Google and Microsoft benefit no matter what?

Yes. Google’s Gemini drives additional revenue from pre-existing products, and Microsoft profits from Azure infrastructure, regardless of which AI product ‘wins.’

9. Is all AI innovation at risk of unstable business models?

Not all—companies like Anthropic and Perplexity, along with “big tech” platform players, show how discipline pays off. But overhyped, unfocused labs may struggle if market dynamics change.

10. How should a local business choose an AI provider?

Prioritize stability, support, and pricing transparency. If possible, avoid vendor lock-in and use platforms that commit to business, not just consumer, value.

11. Can an agency safely build on ChatGPT?

ChatGPT offers unbeatable scale and capability, but the rapid pace of change and lack of clear profitability create risk. Use it, but diversify your stack.

12. What’s Perplexity’s unique selling point?

Live, up-to-date research with citation-backed answers. This makes it invaluable for accuracy-dependent professionals like lawyers, consultants, and researchers.

13. How can agencies future-proof AI-enabled workflows?

Don’t tie your business to a single vendor. Mix and match tools, monitor vendor profitability, and stay agile with your tech stack.

14. What happens if OpenAI changes pricing or access?

You’ll need a backup plan—fast. Model-agnostic workflows (using Claude, Gemini, or Perplexity as alternatives) protect your deliverables if prices skyrocket or policies shift.

15. Does AI vendor profitability affect product development?

Absolutely. Profitable players can afford longer-term investment in product improvements, compliance, and support. Unprofitable ones will prioritize revenue at all costs—sometimes at user expense.

16. Why might prices go up in the coming years?

As AI computing becomes more expensive and VC subsidy declines, companies will need to recoup investments. The days of unsustainably cheap or free tiers may be numbered.

17. What makes Google’s Gemini especially defensible?

Gemini is baked into products companies already use—Workspace, Search, Ads. That base makes it almost impossible for competitors to disrupt without massive user behavior change.

18. Can a professional just use Perplexity alone?

It depends on the workflow—Perplexity is superb for research, but some creative or unique LLM tasks may require ChatGPT, Claude, or Gemini in combination.

19. How do you recommend explaining AI vendor choice to clients?

Frame it as a business risk management decision—show clients how mixing AI vendors delivers both innovation and continuity, even if a big player stumbles.

20. Should I watch for new entrants in AI, or is the market locked now?

Watch, but staying with major profitable players is safest for critical workflows. Occasionally, a new model will break through, but the infrastructure, compliance, and support needs mean incumbents have a big edge.

Jason Wade — AI Visibility Architect & Founder of NinjaAiOS

Jason Wade is the architect behind NinjaAiOS, a multi-layered AI visibility operating system built to redefine how small and mid-sized businesses are discovered in the AI era. He doesn’t build websites, agencies, or campaigns — he builds visibility infrastructure: content engines, GEO/AEO discovery frameworks, automated audits, local knowledge systems, dashboards, and certification layers that didn’t exist before he created them.

In a landscape where most agencies still sell tactics, Jason is building the category itself. He’s the founder of AI Visibility for Main Street, designing the discovery architecture that future businesses will depend on to appear inside ChatGPT, Perplexity, Gemini, Apple Intelligence, and every emerging AI search surface.

NinjaAiOS is the culmination of his approach — an orchestrated system that blends generative content automation, entity optimization, AI-driven mapping, dynamic dashboards, and real-time visibility intelligence into one unified platform. Instead of chasing algorithms, Jason builds the structures that algorithms reward.

Over seven months, he’s advanced from traditional SEO into a genuine new discipline: architecting end-to-end AI discovery systems that compress years of strategy into hours of automated output. His work fuses technical engineering instincts with small-town entrepreneurial grit, giving local businesses access to the kind of machine-intelligence frameworks previously reserved for global brands.

Jason’s mission is simple and ambitious:

Rebuild Main Street’s competitive edge using AI-powered discovery architecture that changes how America finds local businesses.

His OS.

His category.

His movement.

And he’s just getting started.

More: https://jason-wade-0qhw5qv.gamma.site

Insights to fuel your business

Sign up to get industry insights, trends, and more in your inbox.

Contact Us

We will get back to you as soon as possible.

Please try again later.

SHARE THIS